Table of Content

In addition to limiting claiming the mortgage interest deduction, the TCJA substantially raised the standard deduction. In 2022, the standard deduction is $12,950 for single filers and married couples filing separately or $25,900 for married couples filing jointly, rising to $13,850 for single filers and $27,700 for couples in 2023. If the amount on Form 1040 or 1040-SR, line 11, is more than $100,000 ($50,000 if married filing separately), your deduction is limited.

A Form W-9, Request for Taxpayer Identification Number and Certification, can be used for this purpose. Failure to meet any of these requirements may result in a $50 penalty for each failure. The TIN can be either a social security number, an individual taxpayer identification number , or an employer identification number.

What is a Home Equity Line of Credit?

You can’t deduct home mortgage interest unless the following conditions are met. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. Average Mortgage BalanceAverage of first and last balance method. And one of the biggest risks is that you’re reducing the hard-earned equity in your home. If your home’s value depreciates, you risk being upside-down — meaning you could end up owing more than your house is worth.

All of your interest on all the mortgages included on line 12 is deductible as home mortgage interest on Schedule A . You can deduct all of the interest you paid during the year on mortgages secured by your main home or second home in either of the following two situations. The cost of building or substantially improving a qualified home includes the costs to acquire real property and building materials, fees for architects and design plans, and required building permits. You build or substantially improve your home and take out the mortgage before the work is completed. The home acquisition debt is limited to the amount of the expenses incurred within 24 months before the date of the mortgage. Home acquisition debt is a mortgage you took out after October 13, 1987, to buy, build, or substantially improve a qualified home .

Are There Any Limits When Deducting Home Equity Loan Interest?

While many of the products reviewed are from our Service Providers, including those with which we are affiliated and those that compensate us, our evaluations are never influenced by them. For more information regarding Bills.com’s relationship with advertised service providers see our Advertiser Disclosures. The Tax Cuts and Jobs Act of 2017 did not eliminate homeowners' ability to deduct interest on home equity loans. However, the Act did impose restrictions on tax-deductible home equity loan interest. While the Tax Cuts and Jobs Act included some permanent changes to the tax code for businesses, many of the provisions for individual taxpayers are set to expire after 2025.

The answer is you can still deduct home equity loan interest. But the rules have changed, and there are more limitations than ever before. The odds of being audited by the Internal Revenue Service are generally low, but you do not want to take any chances. If you plan to use a home equity loan or a HELOC to pay for home repairs or upgrades, be sure to keep receipts for everything that you spend and bank statements showing where the money went. Thebest uses of tappable home equityare for expenses that will increase your property's value, such as home renovations, or expenses that are investments in your future, like college tuition. It's advisable not to use a home equity loan for nonessential purchases, such as a vacation, because your home serves as collateral to secure the loan.

Are Home Interest Loans Deductible From Taxes?

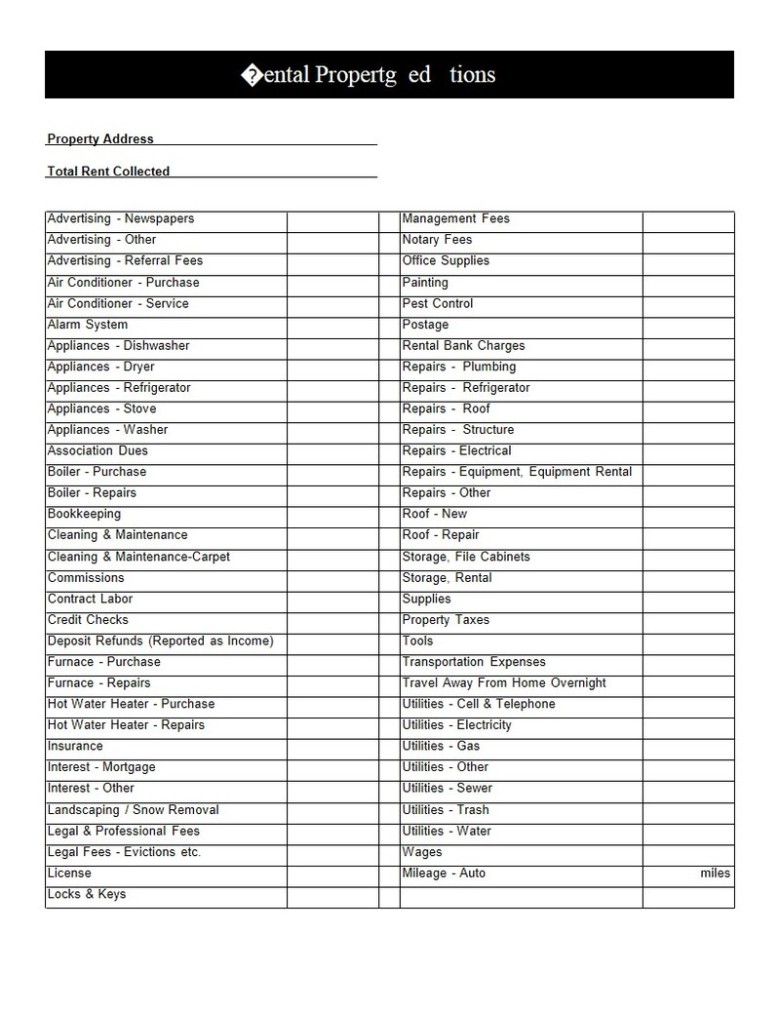

Where To Deduct Your Interest Expense Form 1040, Schedule E, Table 2. Where To Deduct Your Interest Expense Form 1040, Schedule F, Table 2. Where To Deduct Your Interest Expense Form 1098, Form 1098, Mortgage Interest StatementForm 8396, Mortgage interest credit. TAS works to resolve large-scale problems that affect many taxpayers.

If you need cash and have equity in your home, a home equity loan or a home equity line of credit can be an excellent solution. But the tax aspects of either option are more complicated than they used to be. Interest on a HELOC may be tax deductiblebut there are conditions. ▶ Tips and links to help you determine if you qualify for tax credits and deductions.

That means home equity loan rates probably won't drop much lower anytime soon, as they typically follow interest rate trends. The Fed's upcoming December meeting will also signal what's likely to happen in 2023. Interest rate futures already suggest that rates will settle between 4% and 5%. Increases because you've paid off a higher percentage of your loan. It can be worth taking equity out of your house to tackle important life expenses that you don't have the cash to cover. Discover all the tax benefits that come along with homeownership to minimize your taxable income as much as possible.

Home equity loan closing costs typically range anywhere from 2% to 5% of the loan amount, although some lenders may reduce or waive them altogether. To get a home equity loan with bad credit, you’ll need to jump through more qualifying hoops and will also pay a higher rate than if you have good credit. For example, if you want to refinance high-interest debts, a HELOC may allow you to save a significant amount of interest, even if you don’t get a tax benefit from deducting the interest. But it depends on the lender’s requirements and the type of income you receive. For example, if the majority of your income is reported on a W-2, the lender might approve your HELOC application with just copies of recent pay stubs and two years of W-2 forms from your employer.

However, any home equity funds used for purposes other than for your home aren’t tax deductible. Apply online for expert recommendations with real interest rates and payments. Keep your invoice, receipts and work orders to prove you used your home equity loan funds for home improvements. Also called a uniform residential loan application, have a copy handy as added proof that the home you purchased was a primary residence or second home.

Plus, you get to enjoy living in your newly improved home, while increasing its overall value, and ultimately what you can sell it for down the line. Tappable home equity across the country remains abundant, with average equity per borrower at nearly $300,000. That gives homeowners an advantage when it comes to borrowing money as interest rates continue to hover near 20-year highs. Marc is senior editor at CNET Money, overseeing banking and home equity coverage.